New year, new career?

If words such as takeover, IPOs, financial modeling, research, and bridge loans are some of your favorite conversation topics, you might want to consider investment banking as a career option. The same goes if MSNBC and Bloomberg TV are your go-to channels, and you have an addiction watching the red and green flashing lights of tickers go up and down all day long.

Investments banks have played a major role in M&A, underwriting, and raising money for the corporate world. Although investment banking has lost a lot of its pre 2008 luster, it is still difficult to get a job in this notoriously competitive and demanding industry. But at the same time, it is still a lucrative career choice for its most disciplined players. If you want to emerge as a winner in this field, familiarize yourself with the below:

Who Will Offer You An Entry-Level Role In Investment Banking?

If you wish to be a part of this industry that is constantly involved in shaping the destiny of major corporate houses, you have options to join one of the following:

- Bulge bracket firms consisting of the top investment banks like JP Morgan, Goldman Sachs and Morgan Stanley.

- Regionally oriented IBs or ones located in the middle market like Jefferies, Lazard or Greenhill.

- Boutiques or specialized firms oriented towards a specific industry vertical – ex. program trading, bond-trading, technical analysis, or M&A advisory.

- Merger and Acquisition wing of a large company, like General Electric, as an in house staff member who evaluates strategies for inorganic growth

How Do You Get Into Investment Banking?

To get a desirable role in this industry, you generally need an impressive academic background from a good university with a degree in Finance, Economics, or Business Administration. That said, many investment banks hire people with Liberal Arts degrees because they want diversity. A common career path is to join a global bank as an analyst right after college for two-three years, get an MBA, and then rejoin as an associate.

To be successful in this industry, you need to have strong skills in communication, sales, analytics, math, multi tasking, and execution. Working hours vary from 50-120/week depending upon the firm, region, profile and vertical. And there definitely tend to be rather long and demanding hours plus a lot of face time in the first several years.

Finally, having connections is a large part of getting in. Some people use their alumni network, or have parents who are wealth management clients to get their kids in the door.

What Type Of Salary Range Is There In Investment Banking?

Starting salaries for analysts are now around $80,000 in 2015 after being just $40,000 back in 1999. Total compensation for first year to third year analysts can range from $80,000 – $150,000. Associates with or without MBA degrees generally start at $120,000 – $140,000 base and total compensation goes up to $250,000. In the beginning bonus can range from 0-50% of base, and can move up to one to three times salary later on.

Compensation isn’t what it was pre-2008 and you will often be at the mercy of the markets and the performance of other departments, as well as the firm overall. However, it is still quite a well-paid industry in comparison to a lot of others right out of college if you’re able to land a job at a successful shop.

What Types Of Career Options Are There In Investment Banking?

The list of career options in investment banking is extensive. Career paths include roles in corporate finance, project financing, capital markets, derivatives, structured finance, etc. Some of the most sought after investment banking jobs are mentioned below.

Mergers and Acquisitions: One of the most reputed front-end jobs in IB is a role as an M&A banker, who provide strategic advice to corporations for their inorganic ventures. In order to make strategic and financially worthy deals, having solid skills in financial modeling is a must.

Underwriting: One of the most traditional roles offered in IB is as an underwriter, helping government or corporate clients raise funds through debt or equity. Underwriting bankers need to determine the capital needs of their clients, know and understand the type of demand in the market, and specify the ideal pricing that these securities should receive by working closely with security salespeople and traders.

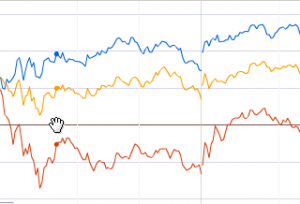

Equites: Sales and trading. If the daily movements of the markets interest you, or if you like to cover large institutional clients, then this is the department for you.

Research: Research roles are typically equity or fixed income focused. These roles require good knowledge of the industry, strong communication skills, sharp analytical skills, and being able to make accurate recommendations to clients for buying, selling, or holding specific stocks or bonds.

Investment Banking is losing out to the sexy tech/internet job market for college graduates today. However, a career in finance will still pay well and provide the skills you need for new opportunities. The average person won’t make the cut due to the competitive nature of getting your foot in the door, and the demands it takes to stay once you get in. But if you are driven, persistent, sales and analytically oriented, love the markets, and are willing and able to work hard for months and years on end, you could do quite well for yourself.

RECOMMENDATION FOR BUILDING WEALTH

Manage Your Finances In One Place: The best way to become financially independent and protect yourself is to get a handle on your finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize. Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Personal Capital to see how my stock accounts are doing and how my net worth is progressing. I can also see how much I’m spending every month.

The best tool is their Portfolio Fee Analyzer which runs your investment portfolio through its software to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was paying! There is no better financial tool online that has helped me more to achieve financial freedom.

It’s 2015 and the bull market continues. Make a decision to be wealthy by taking control of your finances!