Fresh off a two week vacation in Peru, I was reminded of two keys to a successful life…. balance and patience. As a true workaholic, it sometimes takes dragging me thousands of miles from home to to remember the true value of life; and it’s not about who acquires the most money. Clearly, money matters, but so do other aspects of life. Money is the method to achieve some goals, but not all. (It’s tough to travel without any cash :) .)

Now how is this article going to tie together investing, travel, and wealth?

Patience and Investing

An inspiring hike around one of the most amazing sites in the world, Machu Picchu gave new meaning to the word patience. It took close to 150 years to build this historic tribute to the Inca culture. The lessons embedded in this culture are important to us, centuries later.

Are you devastated if you don’t get a remarkable investment return one year?

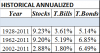

Over the last hundred years or so, the U.S. stock market averaged about 9 percent per year. Yet during the past fifteen years the S & P 500 averaged 4.75 percent (according to Morningstar).

Would there be a Machu Picchu today if the Incas looked at their progress after 15 years and said, “This stinks, we aren’t finished yet, we quit”? Yet this is exactly what many investors did after the bear market of 2008-9. To those investors who sold and didn’t know when to get back in, they missed a great run up in stock prices over the subsequent years.

Let’s carry the example a bit further. How many bloggers quit after a year with the lament that their traffic and income is insufficient? Ramit Sethi of I Will Teach You to be Rich, admitted at a Fincon presentation that his website was nowhere at the three year mark.

Patience with oneself and one’s endeavors is a secret to success. Yet our culture thrives on instant gratification. That mentality leads to dissatisfaction. I’ve invested for decades through up and down markets. There were years when the market tanked and so did our investable assets. Although those were the times when I bit the bullet and added more to our investments. History demonstrates the miracle of compounding; the longer you continue to invest, through up and down markets the more your wealth grows. Many new businesses fail, not because the businesses are inherently poor, but because the owners’ don’t plan well enough, store enough capital, and hang in there during the slow initial stages. Read More