* It’s 2015 now and the bull market rages on!

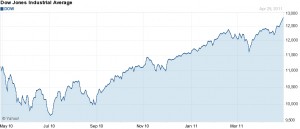

If you were to ask me at the beginning of the year whether I’d accept a 11% return on my overall stock portfolio I would emphatically say, “HELL YES!”. Thanks to fantastic first quarter earnings, the Dow Jones is up 11% and the S&P 500 is up around 9%. Unsurprisingly, my own 401K and stock investments are up around 11% overall as well and I’m sure the same returns have blessed many of you.

It seems like so long ago when the markets plunged due to the tsunami/earthquake in Japan, and even longer ago when the US markets experienced a 10% “flash crash” drop in May, 2010. Right now, everything is hunky dory according to the markets, and you can’t go anywhere without hearing some pundit say how bullish s/he is.

THINGS I WORRY ABOUT

I am an optimist at heart, but I’ve also been burned many times before. After over 10 years of saving and investing, if I can grow my overall net worth by 10% per annum, I’m happy. Therefore, whenever a particular portion of my net worth has risen by 10% or more, I start re-evaluating because history has shown that growing anything over a 10% clip consistently is not sustainable.

Look at Bernie Madoff as an example. His claim to fame was 10% steady YoY returns for decades and people poured $50 billion into his company for him to manage. We’d be fools to think that stocks never go down and everything is perfect right now.

* Now that May has arrived, the majority of companies have already reported their first quarter earnings. The markets have now digested these results and no longer have a strong catalyst to go higher. The markets are now vulnerable to negative events.

* 2012 US state budgets have to be hammered home by the end of June. The closer we get to see how bad the shortfall is, the more jittery the markets will become as people talk about raising taxes further and cutting state stimulus programs. Alarm bells will start sounding off again in municipal bond land, and people will likely sell munis and stocks at the margin.

* The end of May and early June is the start of summer travel season. Volumes will be lower than usual and volatility may therefore be higher than usual. I personally plan to go to Hawaii end of May and blow my tax refund and don’t want to bother having too much exposure to the markets.

* There’s a self-fulfilling prophecy that if everybody starts taking some profits in May, it will happen and the markets will go lower. The best time to sell in May is when the markets have ramped after 1Q earnings, not when the markets have sold off and are week. In other words, now is a precarious time.

* Oil prices will likely continue trending higher as summer and winter are cyclical highs for energy consumption. Consumers will more acutely feel the pain at the pump, and will therefore at the margin start spending less, or slow down their consumption. Spending accounts for 2/3rds of GDP.

* The EuroZone debt issues have not gone away. The markets certainly have put them on the back burner of things to worry about, but we haven’t had Spain or Portugal come entirely clean yet.

* The uprising in North Africa and the Middle East hasn’t suddenly disappeared either. We don’t know exactly what’s going on there because the government and media keep us in the dark. Things are likely much worse than we know.

* Now that Osama Bin Laden has been killed by US special forces, I fear a wave of retaliation as hundreds of new Osamas rise up to take his place and avenge his death. The more the media highlights Americans jumping for joy and chanting “USA, USA, USA” to the world, the more fuel is added to a terrorist’s fire for revenge.

* The average S&P 500 earnings estimate for 2011 is around US$94. With the S&P 500 at 1,370, the market is trading at around 14.8X. Market earnings are expected to grow by 17.8%, 13.2% in 2012, and 10.2% in 2013. As such, a 15X multiple seems pretty fully valued to me.

BRINGING EXPOSURE DOWN

As a result of the above concerns, coupled with a 11% return YTD, I’ve drastically brought my exposure down from 100% equities to 50% equities. The other 50% is in a stable value fund that has a guaranteed yield of 2.1%. In other words, if my equity performance stays at 11% until year-end, my overall portfolio return will be 11.55%. I probably should just sell everything and lock in my 11% gains, but that would be too conservative since I have a full 30% of my net worth in cash and CDs earning around 4%.

Who knows for sure what the markets will do from May till the end of the year. We may return another 10% from here, and never have another pull back again. If this is the case, my stock portfolio would be up 16%, underperforming the broader markets by 5%. Am I OK with this? Yes, I am absolutely OK with being up “only” 16%. If the markets are up 21% in 2011, it’ll also mean the job market is on fire (good for compensation and other employment opportunities), rents are going up (good for rental property owners), and property prices are also going up (good for property owners).

What I’ve learned time and time again is that you can’t lose, if you lock in a gain. You just have to understand what returns you are happy with. If I can consistently grow my overall net worth by 10%+ a year, I’m happy. You might scoff at such a low hurdle, but it gets harder and harder to reach the more you accumulate because you become risk adverse. Growing a $5 million net worth by $500,000 for example, is different from growing a $500,000 net worth by $50,000 because you focus more on capital preservation the more you accumulate.

Have you ever heard of someone on the internet ever lose money in the markets before? Have you ever confused brains with a bull market?

Note: I firmly believe asset allocation is the most important thing. I can’t pick stocks worth crap, and I’m not an investment professional. My rebalancing is based on my own decisions and comfort levels. Please make your own decisions. You can be your own fund manager by building a portfolio of up to 30 stocks for cheap using Motif Investing.

This post was updated on 2/10/2015. It’s a bull market baby!

Regards,

Sam

I have the same concerns as you Sam. The market has been going up steadily for quite some time now, but is it overvalued? I believe yes. And, in addition to your points above, I would also add that the baby boomers will be steadily taking money out of the market for the next 10+ years, which will cause demand to drop, and therefore the value of stocks to drop.

I am still putting money into the market (since I’m still quite young) because if there’s a dip, I’m getting these stocks at a discount. As long as the entire market stays alive and doesn’t crumble, I figure I’ll be ok either way.

You’d think that everything is just going to the moon, and everything is just peachy fine with the way the markets are going. Things just seem a little bit frothy, and I’ve been operating on this 10% hurdle for revaluation for a while now. It works for me, but not for everybody.

Historically, September is supposed to be the worst month for investing. I remember reading about the impending gloom and doom. September went by. We had the best September in 70 years!!

Of course, you’ve made nothing till you actually lock in your profits. How much should be based on a disciplined strategy rather than timing.

If you always rebalanced in May, stick with it. Don’t do it because CNBC says so!

Me? I wont’ be doing anything different! If stocks take a dive, I buy.

I can’t stand CNBC. It’s just a bunch of noise and jibber jabber.

My strategy is simply to rebalance several times a year and re-evaluate after 10%+ total moves up. I’m pretty risk averse and don’t look for homeruns.

How about you?

Pretty similar but I use 5% threshold. If the market tanks I move to buy.

Sam is a bear? I can’t believe it! Time to go all in then ;-)

Seriously I agree the market is overvalued.

Though a 10% increase by itself is not a reason to sell. What matters is the level the overall market is at. I wouldn’t be surprised of a 10-15% correction in the next 3-6 months. Though I was surprised in previous conversations you were 100% equities.

Yep, in my equities portion of my net worth, I have been 100% since last summer. You’ve read a series of posts and know how bullish I’ve been. Here’s one: http://www.financialsamurai.com/2010/07/12/am-i-living-in-a-parallel-universe-the-economy-seems-fine/

I remember so clearly when you and Darwin’s Money were making fun of me on Twitter last year for being such a bull, just like your comment now of taking money off the table :) All I know is that I’m happy with the returns, and am happy to call it a year if the year ended now.

Sam, you know as well as I do 100% in stocks isn’t really investing it’s borders on gambling. In this case your bet paid off. Congrats on kahunas for sticking it out this long.

For me sticking to my asset allocation is what I’ve always suggested. In my case while I do make tactical asset allocation, I’m never 100% equities. 10% max, 5% more common in asset allocation adjustments for me. In my case overall 60% stocks 40% bonds. Though if you look at my detailed blog posts it more the lines of 30% bonds and 10% in alternative assets (RE & commodities)

Again, I was 100% equities in my equities portion of my net worth, which is roughly 25-30% of total net worth. Therese is rental property, private equity, fixed income and cash.

I’m just talking about equities.

Ok I understand you consider your retirement as part of your AA. For me personally I don’t cuz it’s it’s own timeline from other investments.

Though if that were the case you’ve be better off putting stocks in your taxable accounts and bonds in your retirements accounts so you are more tax efficient.

Still searching far and wide for value because it can still be found if you look hard enough. P&C insurance is especially interesting to me right now because P/B ratios are still reasonable, and positive yields can be generated in selling puts. What’s better than getting paid to agree to buy a company for less than book? Heaven?

Transportation is heating up again, which has me irked because it’s my next major play. Railroads are still cheap, always will be, though I’m inclined to wait a little longer for a dip there as I’m sure the markets will panic again, just like they always have. Nothing like picking up a position in an industry that has a near monopoly for almost nothing. CSX, for example, trades at a forward PE of 11 if they get their ratios to their goal. That’s cheap, but it’ll be even cheaper in the next bear market.

It kind of just sounds like you are explaining that you have reached your risk tolerance line…the possible gain that you see is not worth the added downside risk, and that is cool with me!

Just don’t forget those dozen+ Years where the S&P500 gained much more than 20%…

http://historicalreturns-sp500.blogspot.com/

Bingo. It’s all about risk and reward and each person’s tolerance is different.

I do believe stocks can rocket to the moon sometimes, but the S&P 500 at 1,370 is fairly valued IMO. I hope to jump in again, but am happy if this was all the return for the year.

How about you? Share your opinions.

My finances aren’t really set up like yours. I have my 401(k) that is on auto pilot (minus rebalancing and reallocating) and I don’t really want to touch it since it doesn’t matter if there is a sell off or not because that money shouldn’t be touch for 30 some odd years.

Then we have my Dividend account which just has a couple grand and a collection hand picked stocks that have a lower than average P/E ratio (which reminds me that I have to do my 2 month review, thanks lol).

Then everything else is mostly PURE CASH. The Wife and I have been talking about moving soon and I need plenty of PURE CASH for a healthy down payment since I live in a ridiculous part of the country (less ridiculous than yours, but still near insane levels – my down payment is going to have to be the cost of some mid-west blogger’s home…sucks)

So as far as my opinion…I am happy if you are happy lol

To each their own is my point. We all have different levels we are happy with and should re-evaluate constantly.

Scenario to think about. Let’s say you have $300,000 in your 401k after 12 yrs and it drops 20% to $240k for some reason. You are kinda screwed bc the govt only allows us to contribute $16,500 a year! Hence, the more you have, the more risk averse you become.

If we go by historic average, S&P is overheated. It is hovering around 24, average is (15-16).

You are referring PE 10 (Shiller’s)

http://www.multpl.com/

Which tends to smooth out the bumps over time. While it does not mean the stock market can’t go higher it does mean it’s not cheap

Because at 15-16x earnings with earnings growth decelerating to below 15% next year and in 2013, I don’t want to pay more than a 15 multiple.

Frankly, who knows for sure what the earnings figures are. All I know is that I’m comfortable with a 11% return and finished selling half my holdings when the S&P was at 1,265-1,270.

What are your thoughts?

My 401k is also on auto pilot and if the market goes down, that’s good because it’ll help with dollar cost average.

I sold off a bunch of equity recently to raise some cash for a 4 plex down payment so I don’t have a huge amount of equity anymore. If I have extra money, I would buy some dividend stocks since that’s one of my next goal. I guess I am a buy and hold type.

Agreed, the 2008 pull back has been amazing for averaging down. I’ve got a long timeline infront of me (God willing) so I’m not worried about a couple of sharp fluctuations.

I am very bad at market timing, so I rely on asset allocation and dollar cost averaging int the market. I normally re-balance annually.

Rebalancing annually is better than nothing at all!

Agreed. Re-balancing once a year is far better than just leaving it as is. You want to maintain proper diversification.

This is a good thing to think about as markets are reaching higher levels. Personally, I just look to maintain a 25/75 split in fixed income and equity index mutual funds, respectively, because that is what my risk tolerance can stand. Indeed, recently, in order to maintain this split, I have been having to buy more fixed income funds.

I’m just beginning to invest in very conservative mutual funds to balance out our small stock portfolio. The lesson I’ve learned over the past year or so, is to place a stop-loss on my individual stocks so I won’t lose more than I can bear (say like 7%). Last year I (well, my husband that is) invested in a telecommunications company and did not place a stop-loss. Since we were new to investing, we didn’t realize we could lose the entire investment. Lesson learned!

I think that as long as you have a nice balance of conservative and aggressive investments, you’ll do just fine in the long run. (historically speaking.)

Indeed. Long horizons smooth out many of the bumps along the road.

And this is why i’m an index fund investor! I refuse to try and time this market. Why take unnecessary risk when average returns (8%) are consistent? I’m 80/20 stocks to bonds. My stocks include everything from REIT’s to large/small caps. I have a lonnnng retirement horizon so i can take on more stocks vs. fixed income. Simple as that. I rebalanced every 5 years personally. I’m all about keeping things simple in regards to investments. when the markets go down that’s good news for me because I dollar cost average. It’s really a win win situation.

Jon, Ive never heard of anybody lose money in the markets who are on the Internet, and you continue to buttress my belief with your no can lose guaranteed 8% returns. :) Congrats!

There is absolutely nothing wrong with taking gains and deep down, I believe that there is more downside risk over the summer than upside possibility. While I feel this way, I simply have a different approach and am usually heavily invested in stocks but hedged with long puts and short calls. I have many collars in place which ultimately result in a similar end result to what you do when you sell after a 10% gain. The only difference is that I cannot get hurt by a flash crash or sudden market drop with the puts in place.

Sounds good. To each their own. Frankly, who the hell knows what will happen. But, if my portfolio is up 11% in 4 months, I become vary wary and try to understand what’s going on. Therefore, I sold half my positions on Monday morning when the markets ramped again.

Happy you’re happy. Everyone does have their own risk/reward point. The interesting thing about the market is you can make yourself see what you want to see. Sell in May go away. But then you also have historical data can’t predict future results. Bottom line is have a plan and stick to it. You get yourself in trouble when you deviate, you try to compensate, your emotions run wild and then you are sunk, mentally and financially. It does feel a little frothy. Greed and being a contrarian, at times, is making me hang around. Good luck all.

Thx. The contrarian is to actually sell because the herd is very bullish here, which is why we are up 10.62% on the Dow.

Greed is a very powerful emotion, which is why I have my own 10% hurdle to reassess. Everyone is different.

You have a good point there. My being contrarian was to the followers of “Sell in May, Go Away”. Like I said before, the markets can spin us around like a top. Know what return will make you happy and stick to your guns. That is the best way to go!

Nobody can be sure of anything all the time. If we did, we’d be all billionaires!

Selling in May can be good advice. I would keep some money in REITs as long as interest rates stay low!

I’ve been following this strategy and it’s been good to me. Now though with he Feds waving their “going to raise interest rates soon” talks, I wonder how far the REITs will drop, especially high fliers like NLY, O etc…

I hope not too many people fall for it. The fed has been talking out of both sides of their mouths for years. “Strong Dollar Policy” “QE1” “QE2”, yeah, strong dollar policy for sure! In unrelated news, savers are being sucker-punched in the face for keeping money in the bank and trying to earn interest, US authorities are still trying to track down the culprit.

The stock market has never made sense to me. I stopped trading single stock names several years ago after having too much stress and only breaking even or losing money on each of my trades.

Do you mainly stick to ETFs, MutFunds, or are you out of the market completely? Do you do real estate or some other form of investing.

Sam, Well timed article. I’ve been thinking about this very topic and have an article coming out in a couple of weeks chronicling the same issues and my accompanying ambivalence. Since 1870, the average USA market PE is about 15. With the market above that now, there is clear cut evidence that at some point we’re due for a correction. The million $$ question is when? You outlined your decision clearly by incorporating your own risk profile and thinking process. That’s the sign of a thoughtful investor. Nice job.

Hi Barbara, aPpreciate your thoughts. It’s just what I’m comfortable with, which is the main message to everyone. Understand what is “good enough” and go with it, because who knows for sure where anythig goes in the future.

Thx

This is where that one line from every prospectus comes in: “Past performance is not a guarantee of future yadda, yadda, yadda” lol. :)

Hey Sam,

No one ever came out in the red taking profit ;). I understand where you’re coming from though. I tend to think against the market concensus. The herd tends to be slow moving, and not very agile, so when they are sprinting in the bullish direction, they end up getting racked when things go bad.

I think it was Warren Buffett who said (paraphrased) “I try to be greedy when everyone is fearful, and fearful when everyone’s greedy.” It makes sense from my personal experience.

When everyone is bright eyed and bubbly about the market, I’ll just continue making my normal contributions.

Thanks,

Timothy

I just don’t see how people can be THAT bright eyed and bubble. There’s a lot of stuff going on, and if you’re up 10-11%, that’s discounting a lot of goodness already!

It all stems from people not wanting to their own research. They like to turn on their mainstream cable network news and watch the talking heads shout BUY, BUY, BUY! Many investors just can’t seem to think for themselves. The logic goes: if things are good now, then they will have to be greater soon!

Right now I’m more focused on taking care of this year’s expenses, which are large due to moving to a new place. Other than that I am keeping a bit of money on the side and waiting for some good value!

With the way things are moving, I think you’ll see a big dose of good value pretty soon. The commodity markets have been looking rough lately, and that could be a precursor of things to come.

[…] really read before but has some good stuff, Jon from FreeMoneyWisdom on Sam’s post on whether Sam should sell everything this May since he has already made 10% in the market year to […]

[…] the end of 2011 as speculators return with better economic figures in the second half. I’ve sold in May, but I just might have to come back […]

I like the analysis of the earnings being a factor to the market sell off or even just a little bit of a pull back. Smart to rebalance also. I would start buying back in around Aug or Sept. Usually a nice end of year run up with earnings and the Santa Claus rally to pick things up again.

I won’t be selling. My index funds and total asset allocation will remain the same. As for individual stocks, summer can be a nice time to get some discounts. I’ll be looking to increase my positions rather than preemptively sell or reduce any positions.

Hopefully not, b/c it’s now June and the market is down 5%+ since the post! I’m inching back in as well as I actually went down to just 20% equities several days after this post was first published. I want to bring it back to 60%.

Who knows what will happen, but I did know that a 11% return by May 1 was good enough for me.

better stock up on goods before the coming hyperinflation and dollar debasement courtesy of the Fed.

[…] been 100% long the financial markets all year until I cut my equities holdings down to 30% on May 1 after being up 11%. You know from my Twitter stream and various posts that I’ve been […]

I would jump at a guaranteed 10% a year return too. But I try not to re-balance my portfolio every 3 months just because I’ve learned that you get killed on the fees and not to mention the amount of time and effort it takes to stay on top of your portfolio. I prefer to find solid companies and bet on them for the longer term. My typical hold period is 3-5 years which seems to put me in the minority these days.

I’m similar to Iain from Smart Dividend Growth … I tend to hold for long periods of time, in part because of transaction fees, and in part because my preferred method of “rebalancing” is to ADD more money into my portfolio in such a way that it rebalances the overall portfolio (rather than shuffling the existing money around). Obviously there are limits to that strategy, depending on the size of your portfolio, but it works for me at this point.

Hahaha… I’m not a huge sell in May and go away type of investor… there are always opportunities. However, today (Aug. 8, 2011), it sure looks like the investor who sold in May and RAN away would be wiser than 95% who stuck around and watched their recent profits erode!

[…] cash on April 29. The portfolio was up 11% and I wrote an article on Yakezie.com entitled, “Sell In May And Go Away: Stock Rebalancing Time“. I then went 97% cash at the end of October after the markets tanked and came back a […]

Looking back on this call, this was a GREAT call. Nice one Sam. I like your discipline and 10% hurdle rate.

[…] Stock Market. Asset allocated the 401K and stock portfolios correctly. Selling most of my equities at the end of April and going long a majority of my portfolio in November helped bring overall […]

[…] did indeed close up by 5.1%. You might even want to read the post on Yakezie.com discussing how we should rebalance that end of April, 2011 because the markets are up 11%. I may be lucky, but maybe not if you read […]

[…] Stock Rebalancing Time […]

Rebalancing once in a year is not a bad idea. However if we pickup good investments we may need to wait for sometime to enjoy the fruits.