We recently kicked off #YakChat on Twitter a couple weeks ago and it was so much fun! Given most of us work and/or have families, we’ve chosen 6pm PST / 9pm EST every second and fourth Wednesday of the month to engage. With a spacing of every two weeks, the idea is to give the Yakezie Community a chance to connect, discuss something educational, and promote and welcome an expert in the field of discussion.

At the end of each hour long #YakChat, we’ll highlight some of the things we’ve learned in a post like I’m writing today. Knowledge is power, and I’m convinced that the more we know, the wealthier and happier we’ll be. Each #YakChat will have Yakezie Member act as the main moderator who will be responsible for gathering pertinent questions, connecting with an expert, and if possible finding a sponsor as a bonus. The host of a particular #YakChat session will then type up his or her notes in a post and publish for all to read. Thanks to Daniel from Sweating The Big Stuff for kicking off the initiative and hosting the first round!

UNDERSTANDING SOCIAL LENDING IN A WORLD FULL OF INVESTMENT LANDMINES

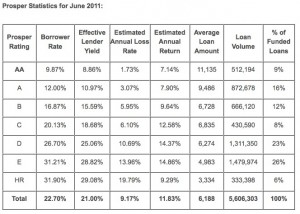

Social lending or peer-to-peer lending as they call it is a new form of investing that is regulated by the SEC. From a lender’s perspective, the idea is that you too can become the bank and directly lend out your own money at rates generally higher than normal. According to Prosper.com, lenders average around 10.59% per annum, although results will vary. Compare 10.6% with the current 10-year yield of ~2%, you can see why social lending has become very attractive to many.

From the borrower’s perspective, they get to tap a new liquidity pool of capital which never existed before. Why wouldn’t the borrower just go to his or her local bank you ask? We learned on #YakChat that the reasons can be several fold:

1) The local bank lacks the flexibility in terms of loan duration. Let’s say you only want to borrow for 6 months. That’s a problem for banks because generally they will only lend out for longer durations.

2) There is massive amount of screening and paperwork by the banks that may go above and beyond what is necessary. This is not necessarily a bad thing, given if banks were more strict with their lending standards, perhaps the 2008 meltdown would not have occurred.

3) A borrower may have an unacceptable level credit score and can’t even get a loan. A borrower may have gone through a bankruptcy 4 years ago and has since cleaned up his balance sheet and found a higher paying job. But, because of the BK, banks won’t lend even at a higher borrowing rate. For a higher borrowing rate, P2P sites such as Prosper.com will match a willing lender to this borrower. According to Prosper.com though, the credit score of their “high-credit quality consumers” is roughly 731 based on Experian Scorex PLUS credit score.

EVERYTHING HAS A PRICE

The key fear for many on #YakChat is whether borrowers will default and lenders lose all their money. As a P2P lender, you can choose to lend to riskier borrowers at a higher interest rate, or to less-risky borrowers at a lower interest rate. It is up to you to construct a portfolio of enough borrowers so that if one defaults, your returns don’t overly suffer.

As I am personally a more conservative investor, I would choose the less-risky borrower, and spread my money across hundreds of lenders. If I can achieve a 6% return, or 3X that of the 10-year risk free rate, I’m happy. Part of the reason why I’m conservative is that I hate losing money and like to employ a large absolute amount of money in any investment I deem worthy. For those of you who plan to do P2P lending for fun and just throw in several thousand bucks, you might be more risk loving to seek higher returns.

Another concern from #YakChat is the amount of paperwork involved. Nobody likes paperwork, but Prosper.com mentioned that joining is just like opening up an account at your local bank or online broker. In other words, it’s no more or less painful than any other institution you join.

OTHER INTERESTING POINTS

The average balance at Prosper.com was hard to pin down. The range was wide i.e. $5,000 to a million bucks. The more important thing to understand is the median, which may tell us what the conviction level is of lenders in the program.

If you’ve only got $2,000 bucks investing in P2P lending, then you really don’t have much conviction because a 10% annual return is just $200. This is why it’s important when you read sites that strongly push P2P lending, and highlight their own fantastic returns to ask them straight up how much they have invested in P2P. If they don’t have at least $5,000, or better yet $10,000, then you have to question their conviction level. They may very well be making more affiliate revenue off of you than their returns!

It’s also good to understand how Prosper.com makes money. For borrowers there is a closing fee of 1% of the amount borrowed for AA-D credit grades, and 2% for E-HR credit grades. The minimum closing fee is set at $25. For non-electronic loan payments there is an additional 1% charge (this is an optional fee).

For lenders there is a 0.5% loan servicing fee for AA-A credit grades, and a 1% servicing fee for B-HR credit grades. These fees are deducted from each loan payment as they are received. So, for an E or HR loan Prosper is earning a total of 3% of the loan amount, while for an A or AA loan Prosper’s take is 1.5%. In other words, Prosper.com makes anywhere from 1.5-3% on every loan. Therefore, Prosper.com’s goal is to get as many lenders and borrowers as possible.

CONCLUSION

Prosper.com asked #YakChat a good question to wrap things up. Do you see social lending as an investment class? Anything that has to do with deploying capital to make returns is investing in my opinion. If you don’t know what you’re doing, you can lose money, which is why you need to educate yourself as much as possible! There is a reason why if you read Prosper.com’s prospectus that they recommend lenders make at least X amount of money and have Y amount of assets. You can most certainly lose money as there is no such thing as a risk free investment.

My largest hurdle, and perhaps for many others is that we are too lazy to learn and do. Learning about new asset classes takes time. Even after reading as much as we can, we still don’t know everything often times. As a result, I asked on #YakChat whether Prosper.com has a “concierge” type service where an individual representative sets everything up and invests your money based on your desired risk tolerance and target percentage returns. @Prosperloans said to check w/ Glenn, who is in charge of Prosper.com’s social media outreach. If concierge service is a possibility, I think Prosper.com can really differentiate itself and attract customers by highlighting this concierge/advisor role service. Perhaps put a cut off of $10,000 minimum investment and go from there.

Take a look at my two year performance review with Prosper I wrote in 2015.

But I think for 2017 and beyond, the best P2P investment is in real estate crowdsourcing. Check out my RealtyShares review!

I’ve always been curious about lending money on Prosper.com, but I just can’t get over the fact that the people searching for these loans most likely can’t get financing from the bank, which typically means they are a higher-risk candidate. I guess it just freaks me out a little.

Need to look into peer to peer lending. I’m still trying to figure out if its worth it.

I have about $2,500 in my Lending Club account… I was all about it when I started a year and half ago, I have enjoyed a near 15% return on my money. I have two issues with it…first, it’s extremely illiquid, but then again so are my retirement accounts so I should be happy about that, since I shouldnt be touching the money anyways. My main issue, and I would say the only reason why I havent put in more money, is that it’s the least passive investment I can imagine. I might as well get a second job lol, to mitigate the risk I try and buy several loans in small increments, I review all the loan docs and borrower income etc., and then invest in that loan. Let me also say that I live in Michigan so I have to buy them off the secondary market, and searching out the best discounted loans etc. takes a TON of time!!! Quite honestly, if you have the time and determination then I think it’s a great (and possibly fun) way to invest…I just dont feel like monitoring and reinvesting thousands of dollars into $25 increments each day…

I’m personally more a fan of Lending Club than Prosper. Though Prosper has recently changed the way they do lending to match more like Lending Club.

I have a small amount (under $1,000) with Prosper. So far, even my riskiest borrowers have been current on their payments. But these are 5 years loans, and I began in January, so there is still plenty of time for default.

I have sold a couple of my loans on the trading platform prosper provides, and I found it pretty easy to dump loans at a small discount, but found no takers when I tried to sell loans at the value they should be today assuming all future payments get made.

My main concerns are that many borrowers have only partially filled out the additional information requested by Prosper. Also many borrowers are looking to “consolidate” their credit card debts, but the loans they are provided with through prosper have higher interest rates than most credit cards, and it seems to me like someone like that could get a better rate by just working things out with the credit card company.

I try to only select borrowers looking to start businesses or work on home improvement, etc. as these are items that could be difficult to get a loan for by nature. But, I do feel like the borrower can really just lie about what they’re going to use the money for, but that risk is part of getting much much higher returns than a typical investment account could expect.

If I had more money in this, my strategy would probably be to see if I could collect payments on high risk loans for a year, and then dump the loan, since I think the more time passes, the more likely it is that a risky borrower will slip into problems again and default. The difficulty would be to sell the loan for a decent price at that point.

I’ve been both a lender AND a borrower. Don’t assume that the individuals CAN’T get a traditional loan for a bank. For me, I had a 790 credit score at the time and I COULD get a loan…just not at the rate and terms that I wanted. I found the terms better on Prosper AND I liked the idea of paying a community of people. I’ve had two loans on Prosper and paid them both early.

I’m also a lender. So far, no defaults and I’ve had loans for almost 2 years. I’m earning close to 10% returns. Back then you did have to know what you were doing to minimize your risk. The problem is that if you are chasing greater returns you are inherently taking on greater risk. There is no free lunch. Propser does not offer a more hands off approach where you do set your risk level and your investment amount and you basically buy into a fund that has been weighted for your risk. Easy and no thinking involved. I still like to choose individual loans though.

If you want to learn more about it, lots of us have covered it, but I’ve done Finance 101: What the Heck is Peer-to-Peer or P2P Lending? (http://yesiamcheap.com/2009/09/finance-101-what-the-heck-is-peer-to-peer-or-p2p-lending/) and One Year On Prosper (http://yesiamcheap.com/2010/11/one-year-on-prosper/) where I discussed my results. I’m coming up one two years in November and not one default. I think that you can add this to your portfolio provided you can take on the risk.

At Prosper, we were happy to be part of the discussion and enjoy both talking to, and supporting the financial blogger community. We will be at the Personal Financial Blogger Conference in Chicago at the end of the month and I look forward to meeting many of you. Always feel free to contact me (gmillar prosper com) should you need content about peer-to-peer lending or have any questions we might answer about the industry.

Sorry I missed the first Yakchat :( This looks like a great initiative. I have to admit that I am still a little wary of P2P lending. Maybe once I have built up some more play money I will get into it.

Good summary Sam. I participated in this Yakchat and enjoyed it a lot. It was very interesting to see the kinds of questions that came up here. There was certainly a curiosity among participants but also a healthy skepticism about p2p lending.

I have been an investor for over two years now with close to $100K invested between Lending Club and Prosper. And I have been blogging about this topic since late last year. The big concern for most people is defaults and losing principal. These are valid concerns but one that can be mitigated somewhat by studying the pool of historical loans and avoiding loans more likely to default. I think statistical analysis is critical and sites like Lendstats (http://lendstats.com/) and Nickel Steamroller (http://www.nickelsteamroller.com/) should be part of the due diligence for every p2p investor.

My other point is once you have decided on your criteria for selecting loans, with some simple saved searches you can reduce the amount of time to invest dramatically. I invest every week in Lending Club and Prosper but spend literally 10 minutes a week doing so. Although the trading platform mentioned by @MoneyistheRoot is a more cumbersome way to invest. But I know of changes coming there that will make it a bit more user friendly in the future.

Peter, awesome you’ve got close to a 100k in p2p lending and have your site as a resource! What has been your best and worse monthly, 6 month, and yearly returns? All I hear is people making money and never losing.

I am seriously considering parking a good chunk of change in Propser.com and see how it goes. I’d just like someone there to do the I vesting for me.

Awesome to have you as a resource!

I personally would do both like Peter has done.

I have only ever had one down month in p2p lending and that was near the beginning when I wasn’t nearly as diversified as I should be. For anyone with at least $5,000 if you are well diversified (into at least 100 notes, preferably 200) you should never have a down month, quarter or year. Keep in mind you are receiving principal plus interest payments on every note so repayments will offset the occasional default.

I have six total accounts between Lending Club and Prosper ranging from a return of 7% with a conservative Lending Club account to a high of around 20% with one of my Prosper accounts. I am averaging slightly more than 10%. Returns don’t fluctuate dramatically month-to-month unless you have a small number of notes.

Peter, with those returns, it sounds like a no brainer then to participate no? Will a flood of lenders in p2p lead to a reduction in returns as a result?

Do you know if an individual or corp can legally be a direct P2p lender itself? Let’s say I have $100,000, and I want to lend to Yakezie Members at x percentage rate, is that allowed?

Thx

Financial Samurai, It is a no-brainer in my opinion but most investors are inherently skeptical and simply don’t believe the claimed returns are possible. But there are many PF bloggers who have jumped on the p2p lending bandwagon and are doing well. Word is slowly getting out.

You bring up a good point, though, about increased volume. P2P lending volume has increased by over 100% in just the last nine months but we are not seeing any loosening of credit standards yet. I spoke with the CMO at Lending Club last week to talk about the huge influx of cash they had in August. He said they can easily increase the number of qualified borrowers to match this cash. But this is something I am keeping an eye on. We want to make sure returns don’t suffer with dramatically increased volume.

I forgot to answer your other question. Becoming a lender at a set percentage to known individuals is outside the scope of Lending Club and Prosper. But there are several companies that exist for this purpose. Here are some companies that help you setup legally binding paperwork for that kind of transaction: loanback.com/, wikiloan.com/, lendfriend.me

I know that I cant save my searches/criteria on the seconday platform (folioN), and each time I select a loan I have to go back and sort everything again. Such is life when Michigan wont allow direct P2P lending…though I will say, I like being able to see a history of payment from a borrower, and I will ONLY buy loans already at a discount… I bet you can achieve higher returns using the secondary market if you do your research. My other complaint is that as your available money comes in, you need to keep reinvesting instantly, otherwise it sits stagnant….this just takes a lot of work and if you have enough principal in the account then you might even have to check daily.

All that being said, I love P2P lending, us secondary guys just need some easier tools to work with…time = money after all.

Personally for me I wouldn’t be doing P2P if I could only do the secondary market because of said factors.

I agree. By purchasing loans at a discount you can build in a buffer which should mean higher returns. For someone with a great deal of time and patience I think the trading platform could easily yield 2-3% more than the retail platform for investors.

Really interesting that the community has a strong interest with P2P lending, we created a blog post to aware people of your hard work and devotion:

http://blog.peerform.com/financial/personal-finance-blogs-are-making-us-smarter-but-%E2%80%93-will-the-smarts-last/

@Peter – Glad to hear you agree with the trading platform. I have noticed the discounted loans being fewer and further in between as of late…but I can still get a pretty decent deal. I also take some extra time and mark up all the loans I hold and attempt to sell them off… I have only every sold about 4 loans doing so, but at a mark up of roughly 5%-10%… I liken it to the animal crackers or a grill cheese with Madonna’s face in it that sells for a large amount on ebay…no real reason, but there always seems to be a buyer.

@P2PNoob – Nice article, I gave it a read… it’s nice to see the PF blogging communityas a whole get some recognition.

Perfect… I didn’t realize this was taking place. I’ll try to join in during the upcoming chats!

I love P2P lending and have used Prosper since it started – my account was like #100. I’ve just let my portfolio run, and it has performed very well. I do consider lending to be an asset class and it has it’s risks just like any other investment.

This is why I love blogging…. learned something new today :) Very interesting…

I had so much fun participating in the Prosper yakchat! I didn’t know much at all about P2P beforehand and it’s something I’m definitely going to consider when I get some more cash for investing.

Looking forward to the next #YakChat! A 10.59% return is good, and something that I would think most everybody would enjoy receiving.

I’ve just been dipping my toes in the world of P2P lending. I only have about $100 in my Lending Club account right now (so I could, ostensibly, lose it all quite easily), but so far, it’s been smooth sailing.

I haven’t had a chance to experience peer to peer lending yet. I am really keen to look into it more though. In Canada, I have some different options to look at compared to the USA but I think they are still good. The risks definitely need to be considered though. Other organizations that allow you to invest in building up communities in poorer countries really interest me. I am looking into those too since my goal is to make as much of a positive difference in this world as I can.

Are these companies specific to the US? I believe that Kiva.org does peer to peer lending around the world, with a charitable aspect to it.

@MoneyIsTheRoot Thank you for reading it,yes PF blogging community helped many people to recover their financial life.Will it last?We will write a follow up in a year to see the progress.

Great write-up on the first #YakChat! (Love the name). I do not participate in social lending, but am definitely interested in it.

@Frugal – Prosper and Lending Club are limited to the US. Prosper was the first of the for profit P2P’s in the US. In Europe, there’s a similiar P2P lender called Zopa, that’s a bit older. Canada also has a few as well. You are right, Kiva.org is a completely different model where lenders lend around the world, but do not make a profit and do it totally from the goodness of their hearts. There’s also MicroPlace (an eBay subsidiary) which is a cross between Kiva and Prosper in that the money goes to small business in the third world, but you do make a small (3-4%) interest rate if the loan doesn’t default. You can see each of these have their place depending on the lender’s motivations.

Thank you for the information and resources Glenn! It’s nice to see how these social lending sites have carved out different niches for different motivations.

My pleasure. Let me know if there’s any information you need. Feel free to email me at gmillar at prosper.

Interesting thread. I’ve been thinking about this platform for years, but have yet to devote the time to dive in and manage. The one drawback that I saw was that when I investigated Prosper they recommended loaning in $50.00 increments to reduce risk. That seemed like an inordinate amount of loans to follow for a 10-20K investment. Any thoughts?

@Barb – We do recommend a very diversified portfolio. The more loans you have, the less any one default will affect your overall return. And our minimum investment is $25. However, it is not the investment amount which is as critical as the number of different loans and the size of your average loan as compared with your total portfolio. For example, one of Prosper’s larger investors has over $5 million invested with 1200 loans. If you make your target at least 100 loans, then you can make each of your loans much larger than $25. You can use Quick Invest on the Prosper site to make the process quicker and easier. If you are interested in investing more than $25,000, we can also set you up with our concierge service.

@Glenn – I share Barbara’s concerns. You CAN make your loans larger than $25 or $50, but that means more risk. I assume “Quick Invest” is something that will take a sum of money and divide it into different loans automatically based on your desired risk etc. This is another reason I advocate the secondary market for these loans, you can view the borrowers original listing and review it yourself. I have seen borrowers with perfectly good credit scores borrowing too much and making too little, and for reasons they shouldnt be taking loans…not sure how I would handle not having this control.

@Money – Quick Invest just allows you to do a search by dozens of different filtering criteria based on your level of risk. You can then look at each loan individually and invest or approve all the loans in one fell swoop and invest. Personally, (and this is not a recommendation which may or may not reflect the position of Prosper), I like to use Quick Invest and then read the description in each loan before I invest. Others don’t care about reading the descriptions and use the invest all at once method.

I haven’t really looked into P2P lending, but the idea is pretty neat. I wonder what’s available up here in Canada. I’m going to have to check this out sometime.

@Invest It Wisely, In Canada you should check our CommunityLend.com although you have to live in BC, ON or QC to participate. They are the most established p2p lender north of the border.

I haven’t looked into it — my immediate focus is on maxing out my retirement accounts and buying a second investment property — but I think its an interesting idea. I generally like how the internet has “democratized” transactions by removing the middle man (banks), who once had a monopoly on lending. Anything that can bring people closer to people in the spirit of fair commerce is, in my book, a good thing.

@paula – Just saw your blog for the first time. You have an impressive story. I just subscribed. ;)

I’ve never heard of Prosper.com sounds like a noble thing they’re doing. I’m a little apprehensive about lending my money to people who probably can’t get bank loans / traditional loans. But I’m interested in looking further into this. thanks for the info!

@Jeremy – Prosper has been in business since 2006 and launched the for-profit p2p lending industry in the US. We are regulated by the SEC and completely transparent. Actually, many of our borrowers can go through banks, (we don’t loan to anyone with less than a 640 credit score, so our borrowers are prime and super-prime) but for a variety of reasons they come to us. Our lenders invest for a variety of reasons as well, although our average lender returns of 10.6% are appealing. (Notes offered by Prospectus.) For more info, check out 2 third party blogs, http://www.sociallending.net and http://www.lendstats.com.

[…] that brought in several comments from prospective investors. Sam from Financial Samurai wrote this article on the Yakezie blog that also garnered many comments. Other recent blog posts that have prompted some discussion […]