When people complain about the cost of education, is it really the cost they are complaining about, or is it the return on the investment they are receiving? I think it is the latter.

Everyone knows that education costs have been rising dramatically in the United States, while at the same time; entry level wages of college graduates has dropped over the last decade. So what does this mean for the individual student or graduate? The return on the cost of education has fallen over the last decade. That is the real problem, and student loans compound it.

Why The Return Is The Problem

Let’s take a deeper look at the return on education, and how it is directly impacting graduates. I don’t think that it affects all graduates the same – just certain ones who attend certain schools. So, for this example, we will look at three cases.

First, we have a student that wants to get a liberal arts degree (say, history). Second, we have a student that wants a computer science/engineering degree. And finally, we have a medical student.

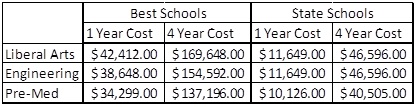

These students have choices in where they can go to school: the best schools for their majors, or a state (public) school. I’m going to use the US News and World Reports rankings for schools, and average the cost of tuition for the top three. For reference, all the top state schools had liberal arts and engineering programs, but I selected the top state schools that had a pre-med program.

We also know that doctors require a graduate education, and the calculation above was for pre-med only. The average cost of graduate medical school is an additional $141,132.

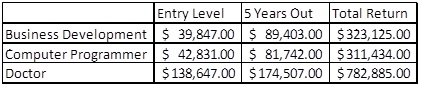

However, this is only half the equation. To calculate the return, we need to look at the average salaries after graduation. This can be very subjective, especially in the liberal arts majors. So first, I’m going to declare that all liberal arts majors go into business, sales, or general office work (which they clearly do not, but it highlights the picture). This is the most popular field for history majors, and it correlates with liberal arts majors in general, since most in this field do not actually enter a career in their major. Also, we know that there are many types of doctors, and some require a lot more specialization. Based on the average cost above, I assume the doctor just becomes a general practitioner, not a specialist.

I used Salary.com to see about what these graduates can make in their fields upon entry. I then look 5 years out, and let’s say these individuals are now promoted 2 levels, or in the doctor’s case, moved up to the 50% average. And then, let’s look at the return on education over 5 years. We’ll assume a standard line growth between the starting salary and ending salary over 5 years. Here is how much total these individuals would make over that period.

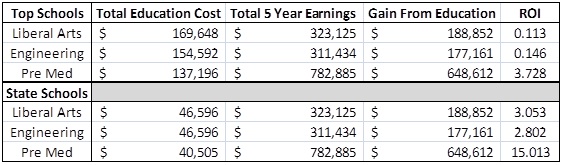

Now, let’s look at the return on investment, which can be calculated: (Gain from Investment – Cost of Investment) / (Cost of Investment). But, the one thing we are missing is the average salary for a non-degreed individual. To save time, the average starting pay for a non-degreed individual is $24,300 per year, and we will assume a 5% raise per year. So, the total earnings after 5 years is only $134,232. We will assume the difference between this and the salaries above as the gain from investment in education.

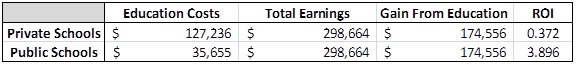

Let’s look at two last facts. First, the National Center for Education Statistics has found that education prices have increased 37% at public institutions (state schools), and 25% at private schools (which all happen to be the top schools in this list).

Next, we know that wage growth has been -7.57% over the last decade. With this, we can infer the following ROI of education from 2000. This is for a liberal arts major, but it applies to all of the above.

Compare this with the ROI from above, and you can see the return on investment in education decreased for both public and private schools over the past decade. The growth in tuition costs, compounded with negative wage growth, has created a lower return on education than in the past.

Student Loans Compound the Problem

Alright, we can put some of that math behind us, and think about an even bigger problem – the fact that almost two-thirds of all graduates last year had student loans. Not only is education costing more, and the return on the investment is decreasing, students are borrowing more than ever to pay for it. It just doesn’t make sense.

Imagine a Wall Street investment that had a decreasing ROI, and yet people were borrowing money to invest in it. It just doesn’t happen. And it shouldn’t with educational expenses either, but it is happening, and it is hurting our students and graduates.

Student loan debt compounds the decreasing ROI problem because not only are students making less than the previous decade of graduates, but they are on the hook for loan payments that are higher than the previous decade as well. So, they make less, owe more, and are generally less well off.

The Solutions

There are several ways for college students to escape this problem, but it requires re-evaluating the consensus thinking on education expenses.

Calculate ROI

First, students should look at their ROI when deciding on schools and career paths. If students don’t, then their parents should. Just using the illustrations above, it is clear to see that the return on a state school is always higher than a return on a private school. As such, for most individuals, a public university will probably be the better option. When doing the calculations, it is fair to consider financial aid, since that may play a factor in private school choices. However, the calculation always has the same variables, so do the math.

Calculate the Cost of Student Loans

Second, student loan debt needs to be figured into the equation. When looking at the costs and the return, it is essential that students don’t borrow more than they can possibly pay back in 5 to 10 years. Student loans can never be discharged in bankruptcy, and so the borrower will always be on the hook for the debt. As such, make sure that you run what it will cost you to pay back each month by using a student loan calculator.

If you borrow your entire liberal arts degree at a private school, your monthly loan payment 6 months after graduation will be a whopping $1,952 per month. If you go with a state school, your payments will be $536 per month. That is a big difference, but even $535 per month can be expensive for a recent college graduate.

Setup Realistic Expectations & Options

The tough part for any student is setting up realistic expectations about education costs and job market prospects after graduation. Yet, it is so essential. I would encourage any potential college student to look at all options available to minimize costs and maximize returns.

There are vocational schools, community colleges, and other programs that could provide more value at less cost. If a college is on the docket, then really look at the expected job prospects upon graduation and what that will mean for any debt repayments.

Education is expensive, yet it is usually necessary. However, there are ways to control costs and be knowledgeable about the expenses and potential returns. ROI is important to consider, but there are other factors. Make sure you consider them all when making this huge investment.

Related post: Should I Go To Public School Or Private School?

Readers, what are your thoughts about the diminishing ROI on education? Is it worth it? Why choose a private school over a public school when the ROI is clearly much worse?

It’s important to still save for retirement despite having student loans. A good method is to methodically pay down debt based off your debt interest rate. For example, if you have 5% student loans interest rate, use 50% of your disposable income to pay off debt. This is called the FS-DAIR.

Looking to learn how to start your own profitable website? Check out my step-by-step guide on how to start a blog. It’s one of the best things I did in 2009 to help earn extra money and break free from Corporate America!

Fantastic post Robert, and right in time before we launch the Yakezie Writing Contest for education!

What this post tells me is this:

* Consider a top public school over ANY private school, especially if you can’t afford it

* “Business” seems to outstrip “engineering” in the long run.

* Liberal Arts is the way to go!

On Liberal Arts, I really think getting a well-rounded degree goes way farther than anything else in undergrad. Not sure why the knock. It’s the Liberal Arts holder that is the business manager over the scores of engineers. It’s why so many of my classmates in bschool were engineers. They hit a ceiling, and couldn’t move on.

If you want to go into specialization, that’s what grad school is for. I don’t expect anybody to be an expert in any field after 4 years of undergrad.

When I went to B-School it was the same. It was scientists and engineers that hat peaked, and wanted to break through to the next level.

I agree with you on the specialization piece but the same rules apply – calculate your ROI on getting a grad school degree. They can be expensive, so make sure it is worth it. Better yet, see if your employer will pay for it!

It can be extremely discouraging to students wanting to go to University when you look at the ROI. It just means students have to know what they want before attending school, as well do a whole lot of research to see if their field of study is in demand.

It’s best if students can avoid student loans all together by working to pay their way through school, getting scholarships, going to a cheaper school, or finding a company that will pay.

It can be disheartening, but think about this:

A student loan’s collateral is your future earnings.

It’s sad, but true. So when you look at education, you also need to look at what you are going to get out of the investment.

I’m frustrated with the amount of debt many students are forced to take on. Also, it seems as though liberal arts grads are basically doomed. There is something wrong with the whole system. I think soaring tuition costs are a big problem, but I’m not sure of the solutions. I really feel compassion for the expense of a college degree today. I think starting in a community college is one alternative.

I think colleges and universities can continue to increase college costs because the payers of the costs are the governments who make the loans. Since the real spending isn’t paid as much by the student, there is no pricing pressure on the system (economics 101).

I think that the biggest consideration that most people don’t realize is that being unemployed with $40,000 in student loans is a lot worse than just being unemployed. I’m not saying college isn’t worth the risk, but the need to earn a return at graduation is far larger.

Very good point about the burden of unemployment and student loan debt. The longer you are are deferring your loans, the more you will end up paying.

I believe that state schools are definitely the better option for undergrad. As far as grad school, the same cannot be said. The most important factor when choosing a graduate school is the staff and the experience they bring to the program.

As far as student loans go, they should not be needed for a public school. The university I attended had a co-op program where I worked for a very reputable company every other semester. I was paid well, received fantastic experience and school credit.

Even if this type of program doesn’t exist at a school, the student can and should get a part time job. I’ll will not hire an intern as a senior if he doesn’t have some type of work experience.

I’m a strong believer of working while in school. Not only does it help pay for the costs, but it gives you real world skills to use once you graduate.

As far as graduate school, I would also argue the point about the importance of networking and building relationships. It can be with staff and faculty, but also peer to peer as well.

I think there is a subjective element that is overlooked in this example. The subjective side is the person getting the degree. Too often, everyone looks at college degrees (including graduate degrees) as an instant answer to wealth. You can have a Harvard MBA and still not be successful because it is still up to the individual to make it happen. It takes a lot of soft and hard skills as well as human skills to find success. Many a great candidates on paper do poorly at interviews for a variety of reasons. I think back years ago when I interviewed stars on paper (resume) and reject them because lack of real life skills. The cost of college and the debt just adds to the problem.

There is a huge subjective part of the equation when you graduate. I am in a very similar situation, where a lot of the smartest and brightest are terrible in interviews or have no real world experience.

Like I mentioned above, that is why I believe it is so important to work or intern in college, so that you gain these subjective skills along with your education.

I studied hard in college and believe that my experience and degree really launched my career so naturally I believe college is important. I definitely agree with your points though that the return on investment is something that really needs to be looked at now but was less of an issue when I went to school. If I have kids I will be so pumped to help them figure out the best options for their higher education. I had to figure out most of that for myself when I was in high school and I wish I had more guidance. I know several recent grads who went to community college for 2-3 years and then transferred to the school they really wanted to go to straight out of high school in order to save money. The cost of community college is SO much lower and being a transfer student isn’t always easy but can be very economical if it works out.

You make a good point that, in the past, you didn’t really have to look at the return on investment for education because 90%+ of the time it worked out. However, over the last decade, the economics of it have changed, and it is important to look at the ROI. There are options, like you mention community college, as well that can boost the ROI.

I thought the ROI arguments were really sound here. I do agree with what Sam said in his first comment about being well rounded. While I think costs are a major contributor I don’t think you should rule out the qualitative experience different schools provide. I’m always a huge fan of maximizing return but I also like to sprinkle in some utility maximization as well. Your experience at the institution will have an impact on your outcome so fit becomes an important factor – maybe not as important as cost but it will still have an effect on the outcome of four years. Like a few people said 4 years doesn’t make an expert but it does certainly help shape how you will perform in the future. How you perform is largely impacted by how you assimilated and interacted in whatever community you were a part of. So my two cents are to go with a place that maximizes your costs at whatever level your utility is perceived to be maximized. If that doesn’t work you can always transfer somewhere else and just focus on the maximized cost.

Good point about utility and community. I think the one factor to consider at private universities is networking and alumni/career networks. While the costs of these school is substantially higher, you are almost paying a premium for access to these networks. As such, to get higher utility, you need to maximize your use of these tools. The problem is I don’t think many students do.

Especially with current economic conditions over the last 12 months being what they are, alumnae (is that right? lol) are being pressed harder by graduates. Not that it’s a bad thing but a solid community of resources is something to think about when a goal for post grad could be immediate employment.

Good analysis to a big can of worms. I a big fan of education and thankful for the inexpensive state school I attended. With alternatives to learning increasing, I believe the traditional 4 year degree will go the way of AOL dial-up, especially when they keep pricing many out of the market.

A few other points that could mess with your numbers (great start, but hugely complex issue).

-How many graduates actually find work in their field or who switch to a totally different field in 5 years? Not sure, but I’ve switched fields several times since I graduated in 00.

-1st year retention rate (those who come back 2nd year) is a factor http://www.higheredinfo.org/dbrowser/index.php?measure=92

-The average graduation rate within 6 years of beginning is about 55% for US –ouch! (lots of student with debt, and no degree) http://www.higheredinfo.org/dbrowser/?level=nation&mode=graph&state=0&submeasure=27

Great discussion and hopefully one that will happen on national platform.

Good points, as I only looked at 4 years of school. I know a lot of people on the 5 year program, and a few at 6 years just for their undergrad. It can start getting expensive fast if you don’t get out.

Often 18 years old isn’t old enough for you to know exactly what you want to do with your life so getting into such a huge debt and maybe not being happy is the biggest part of the risk as far as I see; Imagine two years into you pre-med you realise this just isn’t you and you know you won’t excel in this field.

Also the pressure to go to college pushes many a person who probably would do fine without it to go. I think education should be hugely subsidised and am quite happy for it to be part government owned and run, the gov will get their return because an educated population will ultimately lead to less people requiring benefits.

Interesting perspective – but does the government subsidize all education, even history and art, or just focus on economic needs? Does it subsidize 4 year colleges, or focus more on vocational schools? BTW, many public universities are publicly subsidized a great extent already.

Most people probably wouldn’t agree with me here but I think it should all be affordable and heavily subsidized, much more than it already is. Canada has been offering much more affordable education for a long time and from my experience Canadian grads are just as, if not more well rounded and educated when they leave.

As to where the money comes from and all that part the discussion gets a lot longer, could take all dat to write down my thoughts but in short just need to look to the countries who are already successfully doing it.

Canadians seem to be doing a lot of things better than the rest of us down south…LOL…

This does not consider medical school expenses. Otherwise a good look at the decreasing rate of return on college degrees.

[…] Does Soaring Tuition Matter If The Returns Are Even Greater? – Yakezie […]

Great breakdown! I really think students and their parents need to sit down and discuss the cost and the realistic outcome at the end of the 4-years (or degree). There’s no point taking out a whopper of a loan if the student is flaky, not sure what they want to do, or selecting a vague degree. Public and/or state schools are just fine for most people and cost less in the long run. Community college is also an excellent starting point for those who aren’t sure what they want to major in (Sydney mentioned this above and this is a great way to save money.)

The parents play a huge part in this discussion, and need to make sure they are helping their child make the smart choice. Like Forest said, that can be pretty hard for an 18 year-old to do.

I did not go to collage and wish I did when a snot nosed kid with no experience takes a job from me only because he had a bachelors in underwater basket weaving.

I think a better option would be to consider two years in community college before transferring over to the best school. If not, transfer to tier 1 public school for the remaining two years( in state first). How about undergrad in foreign country like UK where education is lot cheaper than here in the States.

@Shilpan, I actually went to College first and then went to University and didn’t have to do 4 years of University. It’s a great option!

Canada is also a cheaper option for education.

But it’s the same thing with many situations in America. Schooling, housing, credit… When a profit can be made because nobody does anything about it then these are the consequences. Possible DEBT

I went to private for my undergrad degrees and now I’m going to a public university for my MBA. They are very different, but the value at the public university is great.

I’m glad to hear that!

Starting salaries and salaries five years into a ‘career’ aren’t keeping pace with the increase in college tuition.

No they are not. That is the problem and that is why it is so important to look at the value you’re getting for your education versus the return you will receive.

My kids are entering their senior year of college, so your post is timely. I’m not sure the ROI of private schools is correct, however. When we visited several private schools, one selling point was “retail cost” of school vs. “the bill.” Because of increased endowments and scholarship packages, many private schools are able to cut the out of pocket cost significantly, narrowing the gap and increasing the ROI of these institutions.

Good point. I didn’t include any type of scholarship in the calculations because that is so specific to each student. I know when I went to school, I couldn’t qualify for anything. However, times are changing, and more scholarships are available. Make sure that you are making that a part of your ROI calculation.

Well, there’s a lot of good points in here. Of course there are a lot of assumptions made and these assumptions seem to compound, and of course scholarships play a major role in people’s decisions which can’t be easily quantified in a general way, but even with these drawbacks, this post really brought to light something I hadn’t considered. The investment return. It’s not just the cost, but what you’ll get from the cost in the end. Excellent point!

There will always be a lot of assumptions since each person’s situation is different. But at the end of the day, each person needs to calculate their return on what they will spend for school. There are options beyond a 4 year degree!

[…] For many individuals in the current economy and job market, the thought of going back to business school to gain new skills sounds very appealing. However, it is important to think of the benefits of going to business school, and do they outweigh the costs. I recently wrote an article on the rising cost of education, as well as the falling returns of employment. You may want to look inside the cost of education and the maximization of benefits. […]

[…] sad, but in our society, education does not come cheaply. However, adversity never comes without a solution, and education has scholarships, grants, and […]

Good point, Robert, diminishing returns combined with rising costs have been a double whammy. Degree inflation just ensures people have more debt when they do graduate and hopefully find work.

It’s important for new students to realize that there’s more than one path. I have cousins and an uncle in construction, and they make a killing. The work itself is also very strenuous, so it’s not for everyone, but neither is, say, software development. There are many paths open, and many useful professions. I still believe that education is important but hate that the move toward cheap loans has exploded the price. Up here, we have different problems because costs are rising like crazy but it’s covered by taxpayer money, instead, and now that the government wants to raise tuition there are a lot of protests. The protests aren’t entirely unfounded, since the government has a knack for mismanaging and wasting the money.

[…] I hate to mention Yakezie articles here, because the chance you’ve “forgotten” a piece from that site is about the same chance I’d forget to grab coffee in the morning. However, I have to give props to The College Investor and their Yakezie article Does Soaring Tuition Matter if the Returns Are Even Greater? […]

[…] Income Works at Christian PF 10 Easy Ways to Trim Your Entertainment Budget at Money Crashers Does Soaring Tuition Matter if The Returns Are Even Greater at Yakezie Updates Six Ways to Make Extra Money This Summer at Step Away From The Mall Money Leaks […]

Wow, fantastically detailed post with lots of discussion of the ROI of college degrees. I think that higher education will continue to be worthwhile; in fact, as a larger and larger portion of the population has degrees, I think that having a degree will become increasingly vital to getting any position. If a company has a choice between hiring a college graduate and a non-grad for the same position and same salary, they will always opt for the graduate. At this point, any position more advanced than McDonald’s fry cook requires at least a Bachelor’s degree. As for choosing a more expensive school, the only reason I can really see to do that is because the name of the school is sufficient to give you an edge while hunting for jobs (or possibly if you get a sweet deal on tuition assistance, the sort that enables you to attend for practically nothing).

[…] what the real annual costs are of child raising from parents. Any other tips?Recommended Reading:Does Soaring Tuition Costs Matter If The Returns Are Even Greater?Don’t Have Kids If You Can’t Take Care Of YourselfRegards,Sam Most Popular PostsWhy […]

I’ve been concerned about the rising price of tuition when it comes to clergy. Many future pastors attend private Christian colleges or universities for their undergrad degree (and we just read in this post re: how private colleges cost more than public ones), then attend a private seminary or theological graduate school as part of their ministerial training. It is not uncommon for new pastors to graduate with $50,000 or more in undergrad and graduate debt, but most will start out working in small and/or rural churches where the pay is low and the ability to repay those loans quickly is diminished.

[…] that it is an accredited university. That is key. However, I would have wished she addressed the tuition and the return on education. If you know me, you know that I’m leery on big education expenses when the returns may not […]

[…] for one, did not consider if my education would be a good investment, but wish I had given it some thought. In this article I will go over six key factors that will […]

[…] question, because with the rising cost of tuition (and room and board, and textbooks, etc.), the return on investment of education is starting to be pretty dismal. However, it is important for the student that parents […]

Good analysis, but this overstates the returns to education:

1) need to factor in the opportunity cost of working for the non-educated worker during the 4 years. Thus, at year college graduate plus 5, non-educated worker is in their 9th year of work. No doubt this means a longer than 5 year window needs to be assessed. Would suggest a discount rate approach for future cash flows w/ @ risk free rate since the returns to education are probably complete uncorrelated to financial asset investments

2) This example is only for top tier students at 4 year colleges. A more meaningful example would look at tuitions and employment prospects at tier 2/3/4 colleges where more of the student population resides

3) This ignores the education decisions facing most students and their probabilities of graduation. 75% of US students are part time and only 25% of those graduate. Only 60% of full time college students actually graduate. Those that do graduate, do so in 4.7 years (increasing costs yet again and decreasing ROI).

I think it would be great to see an updated analysis reflecting the above comments, or at least 1 or 2 given 3’s complexity.

I appreciate the author’s desire to simplify the experiment as it improves communication of the issue, but ignoring the above facts misstates materially ROI to education.