Do you know what happens when you sell an income producing asset? You end up spending so much time trying to recreate what you sold in vain. Thanks to inflation, declining interest rates, and a bull market, the asset you sold becomes tougher and tougher to replicate if you don’t buy another asset immediately.

Selling an income producing website is even tougher given it often takes at least a year or two to produce any meaningful type of income. Not only do you lose your voice online, you also lose the relatively passive income and a platform that could lead to many new opportunities.

Bottom line: try not to sell your income producing assets if you want to create greater wealth in your lifetime.

INCOME PRODUCING ASSETS INCREASE IN VALUE AS INTEREST RATES DECLINE

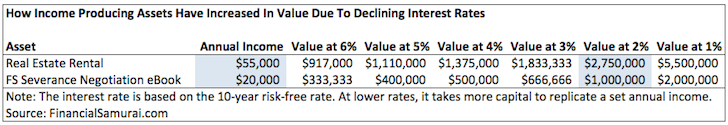

The below is a chart I used in another post on Financial Samurai, highlighting how an income producing asset appreciates in value with a decline in interest rates. Given interest rates have been declining for the past 10 years (30+ years actually), you can see the tremendous increase in value of a sample real estate rental and an eBook from when the 10-year yield was at 6% in 2005, to now 1.85% in 2015.

If you can make a healthy $60,000 a year from blogging like more and more people do, then the value of the blog could literally be worth $3,000,000 based on a 4% interest rate ($60,000 / 4%). If your blog is making $500,000 a year in income, then that value skyrockets to $12,500,000 in value at a 4% interest rate!

The biggest opportunity I see now is websites selling for only 1-4X annual revenue. Given operating margins are very high in the online media world (blogging in particular), we’re talking 2-6X annual earnings, maximum. In other words, a blog with a $600,000 a year annual revenue stream and a $400,000 a year operating profit figure (67% operating profit margin) can be purchased for only $2,400,000 in today’s market.

$2,400,000 is a lot of money, especially to folks who don’t work in high-paying jobs, have never made that type of money before, or don’t come from the world of finance. But paying $2,400,000 for a site with $400,000 a year in operating profits is DIRT CHEAP in any business sector, especially if you have even a remote clue of what you’re doing with the business once you purchase it.

To put it another way, paying $2.4 million for $400,000 in flat operating profits is like getting a 17% annual return on your money. 17% is about 9X the current risk-free rate of return. You’re making 15%+ greater than the risk-free rate, which is a tremendous compensation for a business that likely will remain steady or grow if maintained.

BUY INCOME PRODUCING ASSETS, DON’T SELL THEM

Thanks to a tremendous disconnect in the marketplace for buying income producing websites, you should be buying all day long. If you were lucky enough to buy income producing assets in the downturn (2009-2011), even better because you’ve not only seen appreciation due to a rise in valuations, but also a rise in income as well.

Valuations have expanded since 2009-2011 because there’s a tremendous amount of liquidity chasing not enough assets. The stock market is close to a record high, and real estate in superstar cities like New York City, London, Hong Kong, Singapore, Paris, and San Francisco are way past their previous peak. The capital accounts in China and India are opening up, chasing a tremendous amount of deals here in the US. I’m in tech/internet startup HQ in San Francisco, and Chinese money is everywhere.

Just look at how the richest people in the world built their fortune (Warren Buffet, Bill Gates, Mark Zuckerberg, Carlos Slim, Li Ka-shing, Sam Zell, etc). They all got rich by buying and holding for the long term and building tremendous amounts of equity. Inflation, population growth, ever-rising demand, and globalization are friends of income-producing assets with international consumption ability. Anything online has theoretically a global demand curve!

For blogs, the longer you survive, the larger your competitive advantage. You’ve got that much more credibility, that many more URLs released to the web, and that many more readers to help support your community. You can even parlay your site into a high-paying job related to the online world. Just look at the astronomical valuations for web properties like Upworthy, Buzzfeed, etc. They are all trading at ~25X annual revenue, which is a 100%+ expansion in multiples since 2010!

For fun, take your annual revenue of your website and multiply it by 25X. Welcome to the craziness of the private equity market we know now. Perhaps it’s time to sell? If you can get 25X revenue, probably. But I’d rather be a buyer at 1-3X annual revenue because that’s what smaller sites who aren’t financially savvy are willing to sell for now. If you’ve already sold your income producing asset in the past, I strongly encourage you to find some desperate seller who doesn’t know the value of what they got, to get back in.

Interest rates have been going down for almost 35 years now, and I don’t expect them to suddenly skyrocket any time soon, if ever. Perhaps we get a 1%-2% increase, but that’s it. Meanwhile, the demand for content online just continues to grow. Build your brand, keep up your cadence, and grow your site for as long as you can.

Readers, why do you think people aren’t willing to hold onto their income-producing assets when they just tend to get more and more valuable in a low interest rate environment? Even if interest rates rise by 2%, we are historically still in a low interest rate environment. Have you noticed people sell their sites, and then spend years trying to get back in with no avail? Why do you think people sell their sites for so cheaply?

Related: Ranking The Best Passive Income Investments Today

STARTING A MONEY MAKING BLOG

I never thought I’d be able to quit my job in 2012 just three years after starting Financial Samurai. But by starting one financial crisis day in 2009, Financial Samurai actually makes more than my entire passive income total that took 15 years to build. If you enjoy writing, creating, connecting with people online, and enjoying more freedom, learn how you can set up a WordPress blog in 15 minutes like this one.

Leverage the 3+ billion internet users and build your brand online. There are professional bloggers now who make way more than bankers, doctors, lawyers, and entrepreneurs while having much more fun, much more freedom, and doing less work. Get started. You never know where the journey will take you!

Also consider investing in the best real estate crowdfunding platforms. They are the new wave of investment opportunity for 2017 and beyond as the JOBS Act opens up real estate to more people.

Updated for 2017 and beyond.

Even though I’ve been burnt out many times during my blogging career, I thankfully never wanted to give up. I think a lot of the people who sell their sites are usually totally burnt out, are strapped financially, or aren’t willing to work long enough to start making decent money at it. Anyone who thinks being a blogger and running a site is easy obviously hasn’t tried it for very long! If a blogger hits a roadblock and has absolutely no plans of blogging again, then it’s probably better to sell for something versus just have their site sit there and expire. But I agree with you Sam that it’s a lot harder and way more expensive to sell and then try to get back in later. Hold on to your assets everybody for as long as you can!

Never give up! Now that you are free from Corporate America, your site has become that much more valuable! A great platform to expand and to explore. If you sold your site or gave up before engineering your layoff, then you’d have a larger hole to fill.

Great job on your income reports!

I’ll start with trying to answer you question first, Sam. I think that people start finding maintaining their sites to be a struggle, they secumb to short-term thinking (sometimes because they need money and they need it now) and they don’t wish to leave with the uncertainty of online businesses. I’m not saying that I agree with any of that but…

I do catch myself in a moment of doubt sharing the remptation to ‘cash in’ – on blogs, renta; property etc. Than I catch myself and keep going :).

Oh, and your analysis is spot on. Thing is some get there, others…

Get there or die trying! :)

A blog is not just a money making asset, it is a platform to allow you to do so many things. A blog is a fantastic DYNAMIC resume!

I agree with Sydney and Maria, running a successful blog takes a major commitment of time. I’ve never understood how starting blogs from scratch and selling makes economic sense, at least not as a business model. Buying established blogs with decent link profiles for a good price, putting in some work and later selling for a profit would work only if valuations make sense on both sides of the transaction.

I’m definitely a buyer of blogs, especially at levels many people who are burnt out, or who see $ signs sell for. So cheap! Yet valuations are increasing by the month.

You make a good point about the disconnect between valuations of large websites like Buzzfeed and smaller sites like blogs.

Financially savvier people, those who are investors, for example, see the value and therefore command higher premiums. Smaller site owners usually have no clue about financials and valuations and think, XYZ amount is a lot of money, let’s sell! When they are just giving their sites away at current markets.

Our rental properties are the big income producing assets we own and we have no intentions of selling anytime soon. If my blog made as much as they do I’d be ecstatic. I think blogging takes a different level of commitment than most people realize. I’m certainly learning that even to this day. I can see how it would be discouraging (and tempting to sell at any price) if someone had grand ideas of making money on their blog and never could.

You will be even more ecstatic once your web properties make more than your rental income. I discovered this about three years ago. I used to think rental properties were the best thing ever! Then I worked on my websites, and now web properties are #1. Work from anywhere, low maintenance, easy to hire people to help and fix things.

Yup, makes total sense. I have thought about selling my blog many times. It would feel great to have that one-time payment, but then I would be doing exactly as you said – searching tirelessly to repeat what I had done once before. Instead of earning a quick $10,000 on my blog, why not seek to make a consistent $1,000 a month for life? After just one year I would have earned more than the one-time payout and the earnings would keep coming it. In short, I’m not interested in flipping houses, I’m looking for those long-term rentals that can earn an income for decades to come.

Indeed. Focus on the LT. That’s how massive wealth starts to compound.

When investing in the stock market, I simply invest in index funds and go for the longrun. Once a year I review my asset allocation. When it comes to blogs, or making money blogging, it requires an “active investor”. You need to invest a lot of time and “maybe” you’ll see a return in the future. I’ve been blogging for about 1 year now and although I enjoy it, It hasn’t provider much return. But I know it takes time and I will not give-up!

Don’t give up. I started seeing some results in the 2nd and 3rd year. Your blog’s upside is multiple times higher than the stock market if you put in the effort.

I surely will not give up and meeting people with that have succeded surely helps with the motivation. Looking forward to a “bright” future. Thanks!

This is a great topic Sam. I wonder, why wouldn’t someone simply buy a bunch of blogs, reinvest money in more blogs for a couple of years, and then simply retire from that?

It looks like buying blogs at 2 times revenues could be a good way to make money, with a decent margin of safety. However, it does take time and effort to earn that money. If you don’t want to spend time writing, then you need to hire someone, which would increase payoff time ( probably double it). And I think the issue with blogs is that people come to FS to read YOU. If I bought FS and started writing, then many will stop reading it. So scalability might be an issue.

I think the way to go with online properties is to start something scalable, with user content. SeekingAlpha is a good success story.

Oops, sorry for the long time it took to approve the comment. Been away.

The thing with FS is that 75% of the traffic comes organically through search. So, perhaps if I completely disappeared, I’d lose 25% of all my traffic, but the traffic would still be pretty strong and make a decent passive income stream.

I’m with so many others on this article and I’m glad I found it because it reinforces what I know and learned in personal finance and investing. I started my blog in 2011 and worked really hard on it for two years but was burned out chasing dreams and following tips and tricks that led to nowhere. I let it sit for a year and only recently came back. Thankfully I didn’t try to sell it and paid the hosting and domain for the year ahead of time. I just started back up a couple of months ago with a renewed spirit, an actual plan for income, and am enjoying it thoroughly.

I’m happy to say that after 2 years I’ve had several offers for my webiste that I’ve turned down. Like you say in the article…why sell an income generating asset that’s finally producing on its own.