When people complain about the cost of education, is it really the cost they are complaining about, or is it the return on the investment they are receiving? I think it is the latter.

Everyone knows that education costs have been rising dramatically in the United States, while at the same time; entry level wages of college graduates has dropped over the last decade. So what does this mean for the individual student or graduate? The return on the cost of education has fallen over the last decade. That is the real problem, and student loans compound it.

Why The Return Is The Problem

Let’s take a deeper look at the return on education, and how it is directly impacting graduates. I don’t think that it affects all graduates the same – just certain ones who attend certain schools. So, for this example, we will look at three cases.

First, we have a student that wants to get a liberal arts degree (say, history). Second, we have a student that wants a computer science/engineering degree. And finally, we have a medical student.

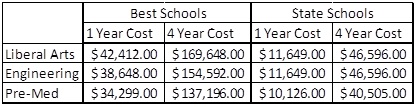

These students have choices in where they can go to school: the best schools for their majors, or a state (public) school. I’m going to use the US News and World Reports rankings for schools, and average the cost of tuition for the top three. For reference, all the top state schools had liberal arts and engineering programs, but I selected the top state schools that had a pre-med program.

We also know that doctors require a graduate education, and the calculation above was for pre-med only. The average cost of graduate medical school is an additional $141,132.

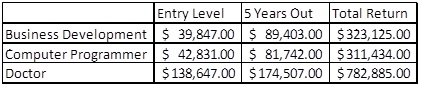

However, this is only half the equation. To calculate the return, we need to look at the average salaries after graduation. This can be very subjective, especially in the liberal arts majors. So first, I’m going to declare that all liberal arts majors go into business, sales, or general office work (which they clearly do not, but it highlights the picture). This is the most popular field for history majors, and it correlates with liberal arts majors in general, since most in this field do not actually enter a career in their major. Also, we know that there are many types of doctors, and some require a lot more specialization. Based on the average cost above, I assume the doctor just becomes a general practitioner, not a specialist.

I used Salary.com to see about what these graduates can make in their fields upon entry. I then look 5 years out, and let’s say these individuals are now promoted 2 levels, or in the doctor’s case, moved up to the 50% average. And then, let’s look at the return on education over 5 years. We’ll assume a standard line growth between the starting salary and ending salary over 5 years. Here is how much total these individuals would make over that period.

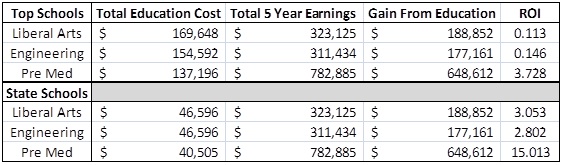

Now, let’s look at the return on investment, which can be calculated: (Gain from Investment – Cost of Investment) / (Cost of Investment). But, the one thing we are missing is the average salary for a non-degreed individual. To save time, the average starting pay for a non-degreed individual is $24,300 per year, and we will assume a 5% raise per year. So, the total earnings after 5 years is only $134,232. We will assume the difference between this and the salaries above as the gain from investment in education.

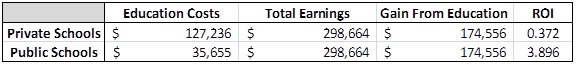

Let’s look at two last facts. First, the National Center for Education Statistics has found that education prices have increased 37% at public institutions (state schools), and 25% at private schools (which all happen to be the top schools in this list).

Next, we know that wage growth has been -7.57% over the last decade. With this, we can infer the following ROI of education from 2000. This is for a liberal arts major, but it applies to all of the above.

Compare this with the ROI from above, and you can see the return on investment in education decreased for both public and private schools over the past decade. The growth in tuition costs, compounded with negative wage growth, has created a lower return on education than in the past.

Student Loans Compound the Problem

Alright, we can put some of that math behind us, and think about an even bigger problem – the fact that almost two-thirds of all graduates last year had student loans. Not only is education costing more, and the return on the investment is decreasing, students are borrowing more than ever to pay for it. It just doesn’t make sense.

Imagine a Wall Street investment that had a decreasing ROI, and yet people were borrowing money to invest in it. It just doesn’t happen. And it shouldn’t with educational expenses either, but it is happening, and it is hurting our students and graduates.

Student loan debt compounds the decreasing ROI problem because not only are students making less than the previous decade of graduates, but they are on the hook for loan payments that are higher than the previous decade as well. So, they make less, owe more, and are generally less well off.

The Solutions

There are several ways for college students to escape this problem, but it requires re-evaluating the consensus thinking on education expenses.

Calculate ROI

First, students should look at their ROI when deciding on schools and career paths. If students don’t, then their parents should. Just using the illustrations above, it is clear to see that the return on a state school is always higher than a return on a private school. As such, for most individuals, a public university will probably be the better option. When doing the calculations, it is fair to consider financial aid, since that may play a factor in private school choices. However, the calculation always has the same variables, so do the math.

Calculate the Cost of Student Loans

Second, student loan debt needs to be figured into the equation. When looking at the costs and the return, it is essential that students don’t borrow more than they can possibly pay back in 5 to 10 years. Student loans can never be discharged in bankruptcy, and so the borrower will always be on the hook for the debt. As such, make sure that you run what it will cost you to pay back each month by using a student loan calculator.

If you borrow your entire liberal arts degree at a private school, your monthly loan payment 6 months after graduation will be a whopping $1,952 per month. If you go with a state school, your payments will be $536 per month. That is a big difference, but even $535 per month can be expensive for a recent college graduate.

Setup Realistic Expectations & Options

The tough part for any student is setting up realistic expectations about education costs and job market prospects after graduation. Yet, it is so essential. I would encourage any potential college student to look at all options available to minimize costs and maximize returns.

There are vocational schools, community colleges, and other programs that could provide more value at less cost. If a college is on the docket, then really look at the expected job prospects upon graduation and what that will mean for any debt repayments.

Education is expensive, yet it is usually necessary. However, there are ways to control costs and be knowledgeable about the expenses and potential returns. ROI is important to consider, but there are other factors. Make sure you consider them all when making this huge investment.

Related post: Should I Go To Public School Or Private School?

Readers, what are your thoughts about the diminishing ROI on education? Is it worth it? Why choose a private school over a public school when the ROI is clearly much worse?

It’s important to still save for retirement despite having student loans. A good method is to methodically pay down debt based off your debt interest rate. For example, if you have 5% student loans interest rate, use 50% of your disposable income to pay off debt. This is called the FS-DAIR.

Looking to learn how to start your own profitable website? Check out my step-by-step guide on how to start a blog. It’s one of the best things I did in 2009 to help earn extra money and break free from Corporate America!