“When the weather changes, nobody believes the laws of physics have changed. Similarly, I don’t believe that when the stock market goes into terrible gyrations its rules have changed.” Benoit Mandelbrot

This brilliant mathematician speaks to the reality that the price of common stocks goes up and down. If you want the possibility of a high return, you need to take some risk.

Across the web there’s been talk about the death of equity investing.

Why? My guess is because investors have short term memories and believe since stock market returns’ under performed their historical averages during the first decade of the new millennium, they will continue to under perform.

Ironically, and the end of the 1990’s there was a similar belief, only in reverse. The media was filled with discussions about how we had moved into a new world of investing and the old rules didn’t apply. In 1999 after a decade of historical out performance of the equity markets, investors believed that the “new normal” would be stock returns in the double digit range.

Well, that didn’t quite pan out.

What happened in the first decade of this millennium is a reversion to the mean. After large out performance of stock investments, the equity markets under performed which moved long term returns closer to their historical averages.

Does that mean the future equity returns will now be lower than historical averages?

I guarantee that no one knows what the future holds!

What is the relationship between investing return and risk?

Understand the relationship between risk and reward and become a smarter investor. There is an unavoidable trade off between risk and reward. Investors demand to be compensated for taking risks and investing in equities is risky.

A risky investment must compensate the investor with a higher return than a safer investment. If the returns were the same, you would always choose the less risky investment!

The reward from investing is the possibility of a high return on your investment dollars.

The real risk in investing is the possibility that your payback won’t be what you expected, but less than you expected. After all no one is unhappy if their return is greater than planned.

How to get a reward from investing?

Empirical research supports the out performance of buying a few low cost diversified index funds in an asset allocation in line with your risk tolerance and holding for the long term. You might buy an international stock index fund, a diversified USA or other country specific diversified fund, and a cash or bond fund.

Rebalance once a year based on your predetermined asset allocation and hold for the long term.

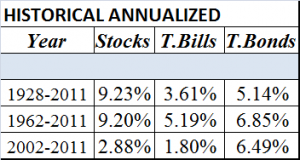

Over the last 80 years, U.S. stocks returned a bit over 9%/year. If history is any guide, your long term returns from stock investments will beat those of cash investments.

But don’t put money into stock investments that you need in the next five to ten years. Due to the volatility, short term returns are quite unpredictable. Long term, you are likely to experience the out performance benefits of investing in a risky asset.

What is the risk?

Stock investments go up and down in price. The risk is almost certain that during a 10-20 year period your investment returns will be negative some years. If history is any guide, over the long term, you will earn more money by investing in stocks than if you kept the money in a bank money market account.

What if you don’t want any risk in your investment dollars?

If you cannot tolerate any fluctuation in investment returns, then put all of your money in the bank or in government bonds. The only problem with that strategy is that inflation will likely eat into the true purchasing power of your cash.

The only way to hold on to your principal purchasing power is with a US government Treasury Inflation Protected Security (TIP) or Government I (inflation) Bond (for USA investors). Those investments will protect your money from inflation risk but offer no possibility of beating the return of inflation.

Why take the risk?

In investing, the greater the potential reward, the greater the risk. Common stocks have the potential to offer high returns over the long term. In the short term equity values move up and down so much that it is impossible to predict whether your return will be positive or negative.

If you want a way to finance long term goals such as retirement, home renovations, down payment on a home, and college expenses for your child, then stock index mutual funds are an excellent vehicle. However, you must be prepared for the ups and downs in the investment markets. Understanding the historical returns of stocks can help you stay the course during the down years.

I recommend taking a look at Personal Capital to help manage your money for free. They are the best free financial software online by allowing you to track your net worth, track your cash flow, and plan for your retirement.

Updated for 2017 and beyond.

I invest in the market now. I started once again in March. Got a bit scared in May but stuck it out and came out shinning. I also sell covered calls to hedge my bets. Helps sleep at night.

I think there are opportunities for certain stocks in any market. Yes, sometimes the Index Funds may be down, but that doesn’t mean that other people aren’t going up. Stock investing is not for timid, but it can be made more smooth if you truly do your homework and do not invest carelessly.

I invest in a target date fund for retirement and in a 60% stock 40% bond fund for my nearer term goals. I hope stocks to continue to perform at historical long term averages or my generation is in for a world of hurt come time for retirement!

I just sold down about 40% of my equity holdings last Friday from 100% allocation down to 60%. I’m going on vacation for a long while, and I feel the market is at the top of the range.

I donno. I can’t help but lock in gains intra year. Perhaps a bad habit. So far, it’s worked OK relative wise.

I’m still bullish on the stock market, but I like to stick with large cap stocks that still tend to perform well regardless of economic conditions.

I’m still invested, roughly 70% equity. I minimize risk by rebalancing quarterly and using dollar cost averaging.

@Jai-Selling calls gives you a bit of insurance (along with a record keeping challenge).

@My Money-I only hold a few individual stocks now, and in both our family portfolio and the one that I manage, I’ve moved toward diversified portfolios of index funds.

@Lance-I second your hopes. Your generation is getting some tough economic breaks right now.

@College-I like your optimism. I too believe in the long term persistence of both the USA and world economies.

@Paul-Dollar cost averaging is the best way to buy low and sell high!!

@Sam-100% is certainly an aggressive position. I’m sure you’ll sleep better with a bit more balance. Have a good vacation!

My only exposure to the markets right now is through the funds in my 401k. I never did well at making money off of single name equities, so I liquidated my PA. I should have waited as I sold on a downward fall, but at least I made a little bit of profit on most of my positions.

“What if you don’t want any risk in your investment dollars?” – then you risk not having enough when you retire (haha, just wrote about this).

Timely article, and I hope people listen. It’s better to deal with a bit of volatility then to hope your kids can cover you when you reach retirement age!

@Untemplater-It’s very tough to study and purchase individual equities at a low and hold them until they appreciate. Even good companies may not be good stock purchases. Empirical research suggests you’ll beat about 70% of active professional portfolio managers by buying a diversified portfolio of index fund (am I a broken record??? :) ). Also, make sure to check out fund fees, high fees is money down the drain.

@PK-Love the analogy, great comment. Who wants to put their future selves in the hands of their kids?

Love your post! :-) My recommendation is to keep the core of your portfolio in low cost index funds and sprinkle in solid active mutual funds (for those that want it) individual stocks and bonds (for those that want it). As you said, make sure to diversify even with index funds. And not all index funds are the same. However, depending on someone’s investable assets, they may want to consider money managers which are not the same as active mutual funds.

Long term investing is the only sure way you will recieve and benefit from the upswings in the market. But with less than 10 years away from needing access to your investments, it is best to take a more conservative approach.

@Ornella, In fact, the biggest up swings in the market take place on just a few days per year, miss those days and you’re returns are much lower than the overall long term (80 years) historical stock returns of 9% annualized. And Ornella, I completely agree, be more conservative with funds you’ll need in the next 5-10 years.

I’m trading pretty actively right now due to the uncertainty in Europe. When I’m holding a position for longer than a few months, I look for stocks with a solid dividend growth rate then I write calls on those positions. Volatility is very low right now though, so option premiums have been down.

Although I have been in the market for a long time, I will remain in the market for an even longer time. I keep investing in good and bad times in a diversified portfolio. It is one of my hedges against inflation. I take a look at my asset allocation annually and tweak it when I add new money into the market. So far so good!

JW-Keep us posted on how it works out for you. Seems like Europe is improving a bit, hope that helps the global economy.

@Krantcents-As the saying goes, it’s time in the market that creates wealth. If only we had unlimited time, then we could all benfit from an eternity of compound growth. Although would have other disadvantages:)

[…] s1); })(); TweetGet Rich One Step at a Time After reading this article, check out my featured post; Risk Versus Reward; Stock Investing is Not Dead at Yakezie.com Remember the wealth in enjoying life’s small […]

Stocks provide value to a person’s portfolio. But if a person’s focus is centered on U.S. equity markets, then they will definitely be disappointed when their diversified portfolio underperforms U.S. equity markets (such as is occurring now with the sharp rally in equity prices). This doesn’t mean diversification is bad or wrong, a diversified portfolio will ALWAYS underperform the best-performing constituents of that portfolio. But to fixate on one constituent (such as U.S. equities) is not investing, but a ‘gambling’ mentality.

I discuss this throughout my book “Jackass Investing: Don’t do it. Profit from it.” (#1 Amazon Kindle best-seller in the mutual fund category). My approach to diversification is quite different from conventional investment wisdom. One concept I think you’ll find most interesting is in that I replace asset classes with “return drivers” and “trading strategies” (as I point out in the book, asset classes are simply long-only trading strategies that do not attempt to disaggregate their many separate return drivers). Once viewed in this fashion it is easy to create a truly diversified portfolio, rather than one constrained by the shackles of asset classes.

I’m pleased to provide a complimentary link to the final chapter of the book, where I present the benefits (greater returns & less risk) of a truly diversified portfolio: http://bit.ly/vxDo6v.

Hi Mike, Diversified investing must include diversification in world index funds, including developed and developing markets. I look forward to checking out the link to your last chapter.

I totally agree. But that’s just the start and international stocks only provide marginally-additional diversification value. To get true diversification investors must diversify across return drivers and trading strategies. In a properly diversified portfolio long stock positions may only make up 20% or so of the portfolio’s value.